Why Should I Buy Insurance?

- To protect your personal property and contents.

- To protect your furniture, appliances, and other personal belongings.

- Protection against liability for accidents that may injure other people or damage their property.

Why Insure with Hand in Hand?

- Longest established insurer in Guyana (since 1865)

- Certified by the Local Content Secretariat

- AM Best Rated Insurers

- Superior customer service

- Reliable and sufficient coverage

- Prompt Claims Settlement

- Affordable and competitive rates

- Eighteen (18) offices countrywide

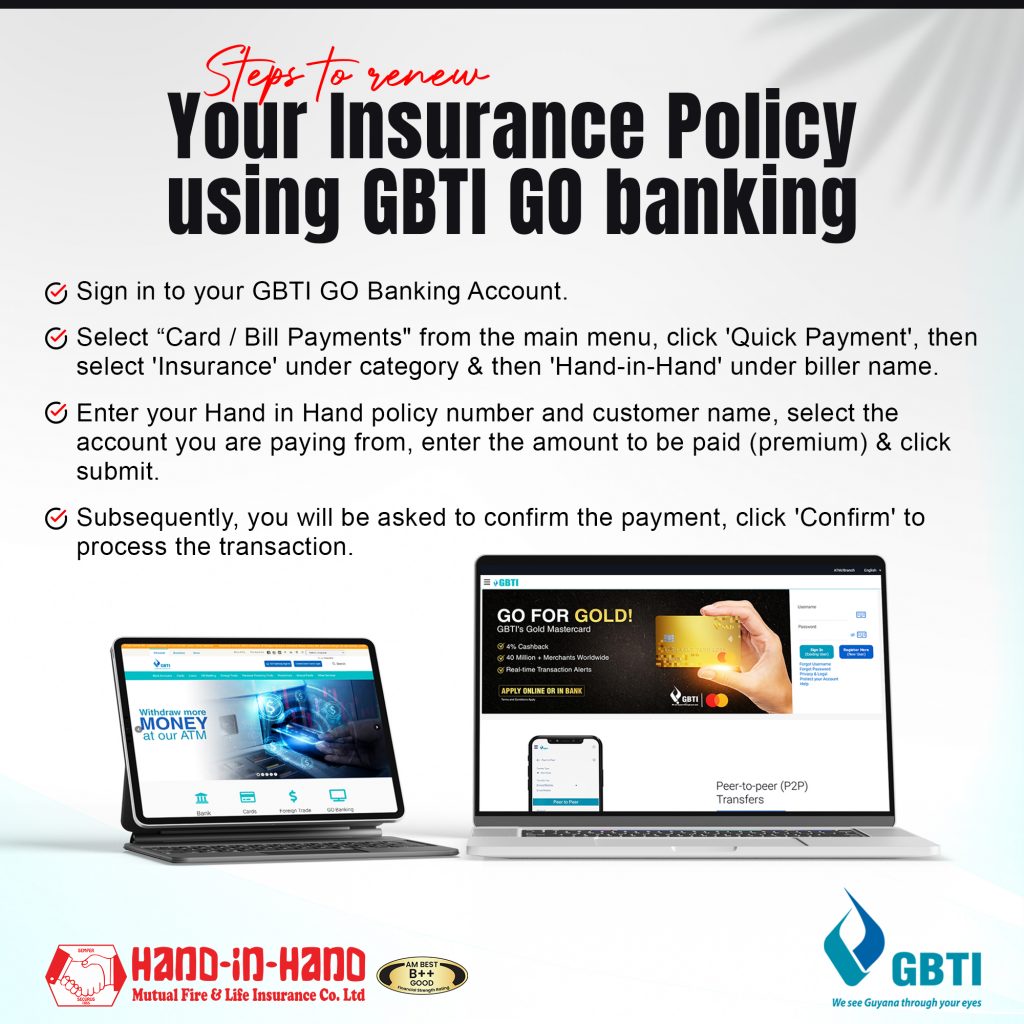

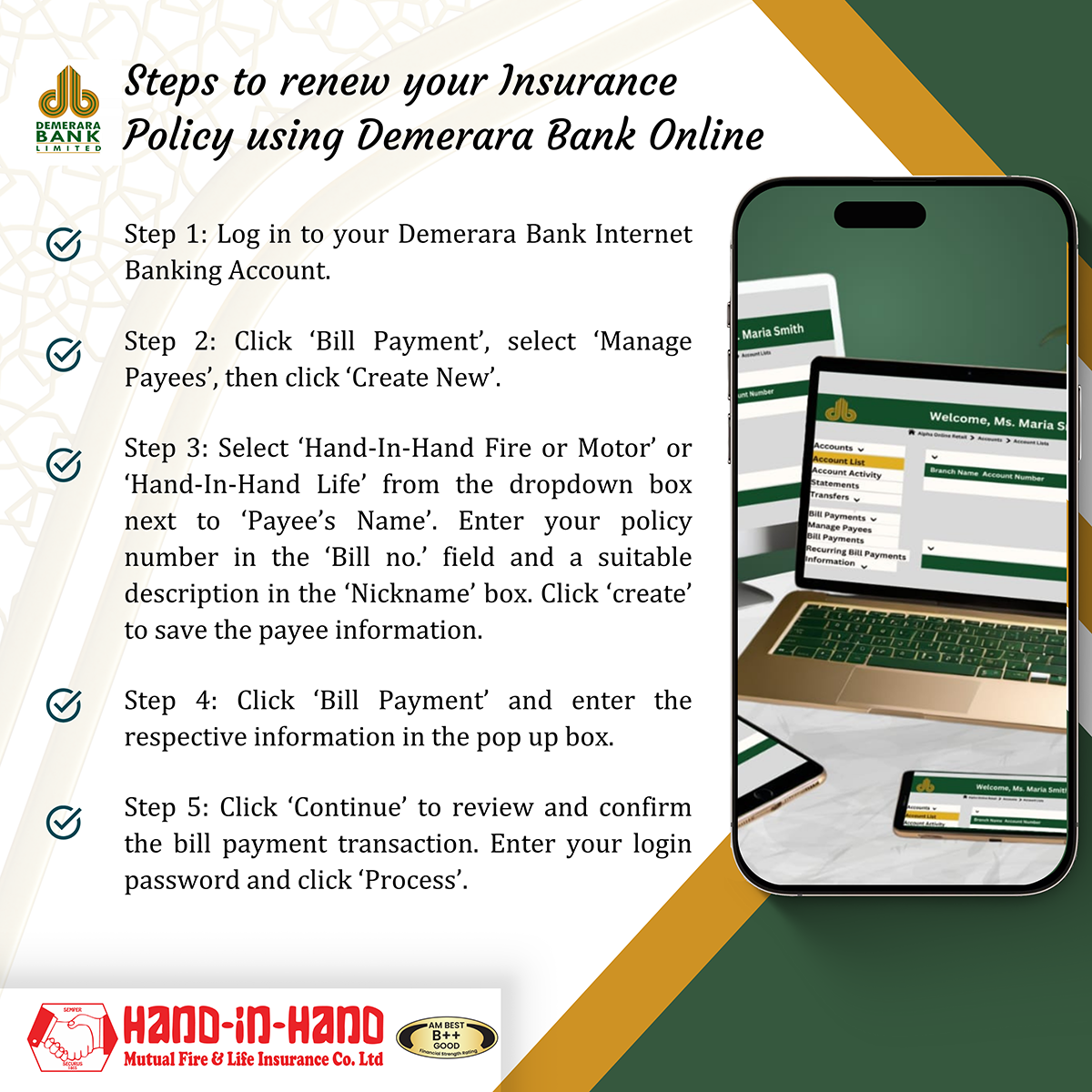

- Convenient renewal options (MMG, Scotia Online, Republic Online, Citizens Online, GBTI GO Banking, Demerara Online)

Residential Insurance Coverages:

Fire and Allied Perils

Our Fire policy covers your Residential Building against damages arising from a wide range of perils. In the event of an incident resulting in property damage, our Fire policy will help you repair or reconstruct your building.

Contents Insurance

Let us safeguard your hard-earned household contents, whether you are the owner of the building or renting.

Householders’ Comprehensive

In addition to the coverage offered by our Fire policy, our Householder’s Comprehensive policy safeguards your property in the event of Theft, accompanied by actual forcible and violent entry into the building or any attempt thereof. Standard extensions provide additional coverage for Rental and Alternative Accommodation, Breakage of Fixed Glass and Sanitary Fixtures, Public & Personal Liability as Owner or Occupier, Temporary Removal, and a Fatal Injury benefit.

‘Hassle Free’ Contents Insurance

Our affordable ‘Hassle Free’ Contents Insurance provides up to $1,000,000 coverage for household items (without requiring a list of contents) against perils including Fire, Lightning, Explosion, Riot, Strike and Malicious Damage, Aircraft Damage, Vehicle and Animal Impact.

Commercial Insurance Coverages:

Material Damage Insurance

Insure your Business property from loss/damage caused by Fire and Allied perils including Earthquake, Hurricane, Storm, Flood, Malicious Damage and Aircraft /Vehicle Impact.

Property “All Risks” Insurance

We can cover your Business assets such as Building, Machinery and Stock from loss/damage caused by All Risks perils. A wide range of extensions may be included such as loss/damage to Plate Glass, Property-in-Trust, Theft, Goods, Cash-in-Transit and Machinery Breakdown.

Business Interruption Insurance

Whilst Material Damage (Fire & Perils or “All Risks”) insurance covers your physical property, Business Interruption insurance provides cover for Loss of Profits and specified expenses following loss/ damage resulting from insured Material Damage perils and it is underwritten in conjunction with Material Damage Cover.

Marine Cargo Insurance

Insure your Cargo either on an ‘All Risks’ or Total Loss basis. Coverage can be issued on a warehouse-to-warehouse or port-to-port basis for Cargo stored in approved shipping containers or in approved ships.

Employer’s Liability Insurance

Protects your business in the event of death or injuries sustained by an employee either on site or off site, as determined by the policy terms.

Public Liability Insurance

Let us cover the cost of claims made by members of the public (third parties) for incidents that occur in

connection with your business activities. This type of policy covers the cost of compensation for personal injuries, loss of or damage to property, bodily injury, or death.

Travel Insurance

Safeguard yourself and your family with our Travel Insurance Policy which provides coverage for medical expenses, personal accident, and lost baggage. The limits and duration of cover can be designed according to your specific requirements.

Contractors’ All Risk Insurance

The cover protects against damage to building works, specified machinery and liability to third parties, within the construction industry.