When Insuring Your Motor Vehicle You Need A Company Which Has:

A Professional Management Team – both Hand-in-Hand and GCIS have an experienced and professional team that offers a superior level of personalized service.

Mission/Vision – provision for a range of diverse products at competitive rates and maintenance of exceptional customer service.

The most innovative in Motor product development within the Motor Insurance industry; while offering the widest limits of liability, focusing on market needs and satisfaction.

Why Insure with Hand in Hand?

- Longest established insurer in Guyana (since 1865)

- Certified by the Local Content Secretariat

- AM Best Rated Insurers

- Superior customer service

- Reliable and sufficient coverage

- Prompt Claims Settlement

- Affordable and competitive rates

- Eighteen (18) offices countrywide

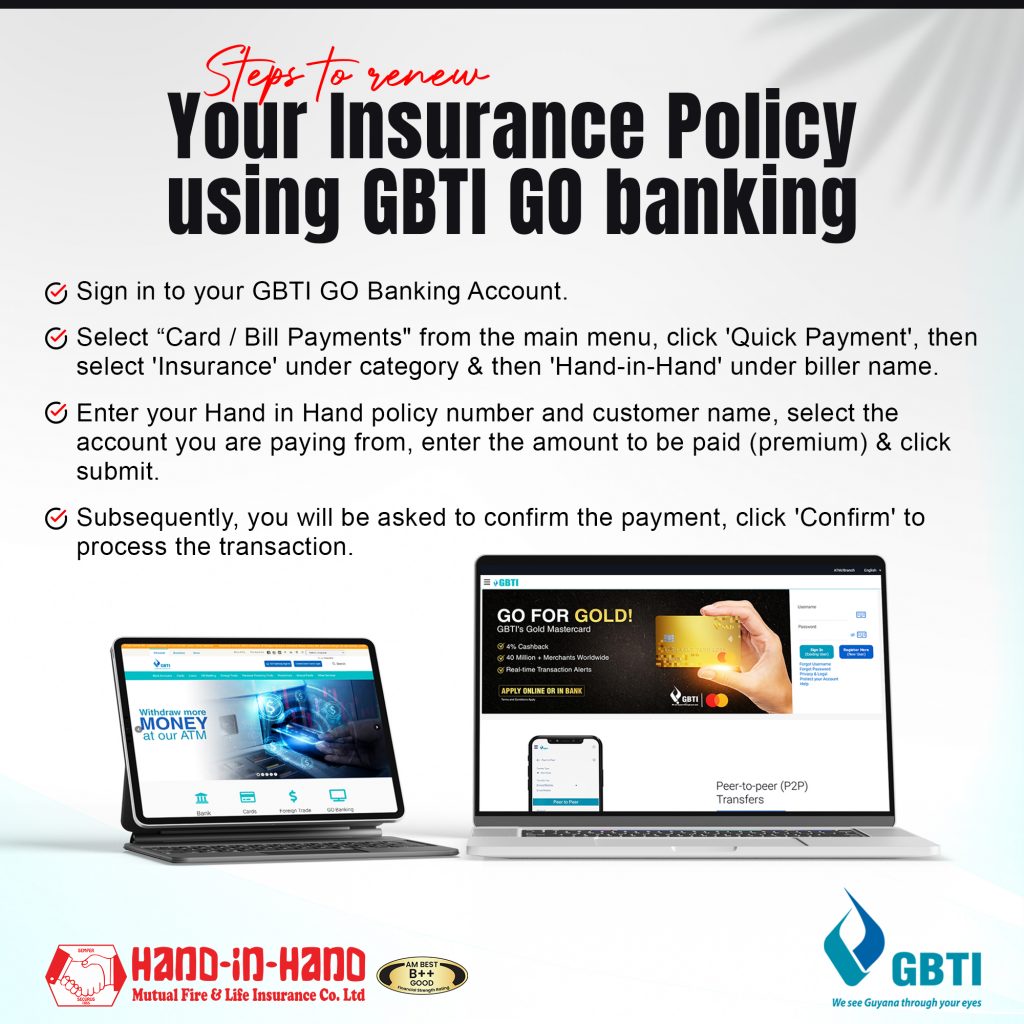

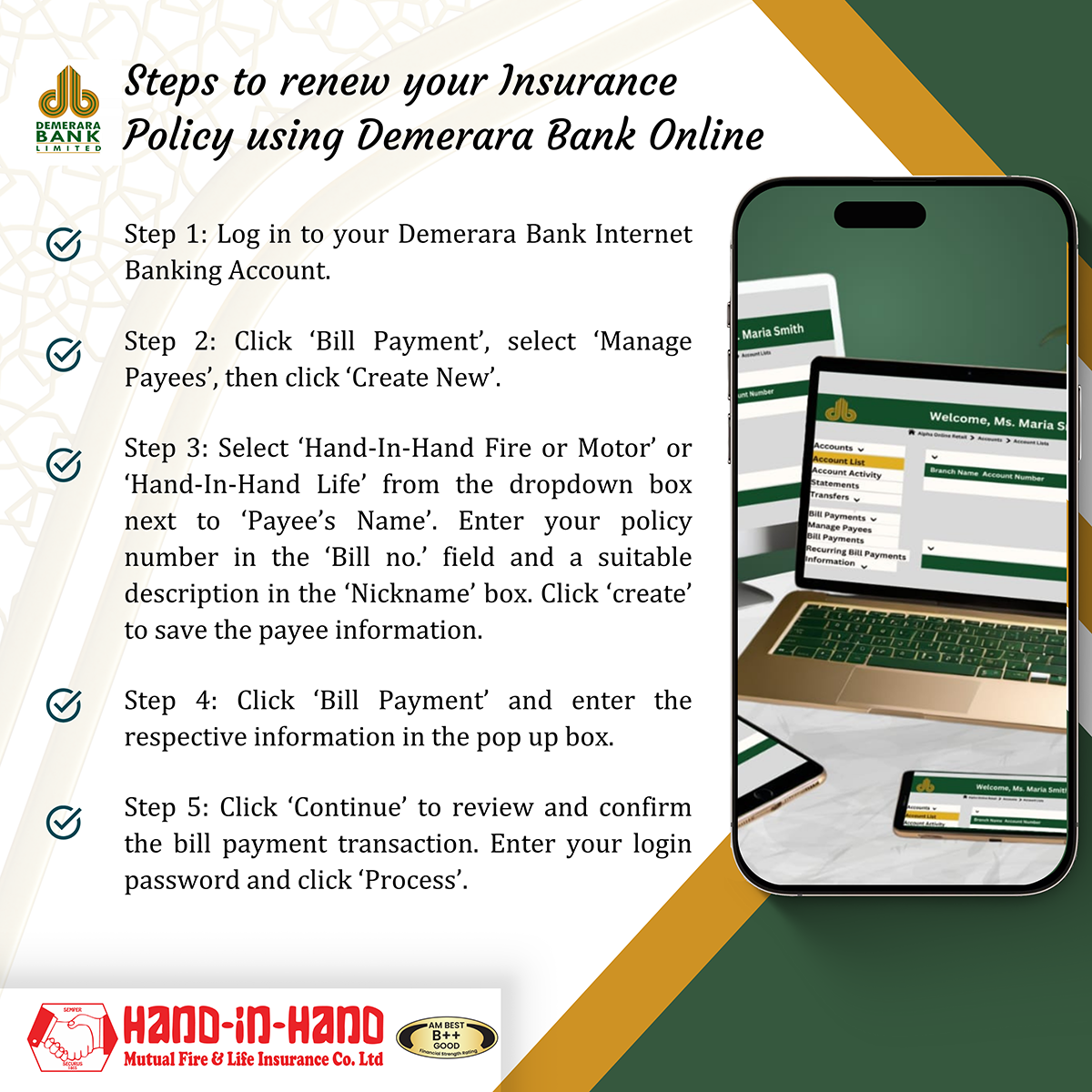

- Convenient renewal options (MMG, Scotia Online, Republic Online, Citizens Online, GBTI GO Banking, Demerara Online)

Benefits of insuring your motor vehicle with Hand-in-Hand:

- Free Suriname Insurance

- Free Windshield Coverage (limit applies)

- Free Auto Glass Coverage (limits applies for Comprehensive Policies only)

- Fleet Discounts (for more than two vehicles insured)

- No Claim Discounts every year when you’re accident free (up to 60%)

- Vanishing Deductible: reward yourself for being a safe driver.

- Bundled Discounts for Fire and Life Policies.

- 10% Discount when you purchase your Motor Insurance Policy Online (https://online.hihgy.com/)

Adequate Rates Ensure Adequate Coverage. Get Quality Insurance!

Accidents can happen at anytime. Therefore, it is our Company’s policy to ensure that all our current and potential policy holders are adequately covered by offering a wide range of Motor insurance services to cater for your needs at affordable rates.

Types of Vehicles Covered:

- Private Vehicles

- Hire Cars/Minibuses

- Light / Heavy Commercial Vehicles

- Motorcycles

- Agricultural Vehicles

- Heavy Duty Equipment

- Mobile Plants

Motor Insurance Coverages:

Third Party (Act, A Limits or B Limits):

This type of Motor Insurance Policy provides coverage for only the Third Party/Parties (other vehicle/ person/ property suffered a loss as a result of an accident with your motor vehicle). It does not provide coverage for the insured’s motor vehicle.

Third Party Fire and Theft:

This type of Motor Insurance Policy covers Third Parties and your motor vehicle; if it is damaged by fire, lightning, explosion, attempted theft or if it is stolen and not recovered.

Comprehensive Full Value/Subject to Average:

In addition to what is offered under Third Party Fire and Theft, this type of coverage extends to accidental damages to safeguard the insured’s vehicle.

Purchase Add-Ons:

- Windshield Cover

- Underinsured Cover

- Uninsured Cover

- Medical Expenses Cover

- Auto Glass Coverage

- Auto Loan / Lease Coverage